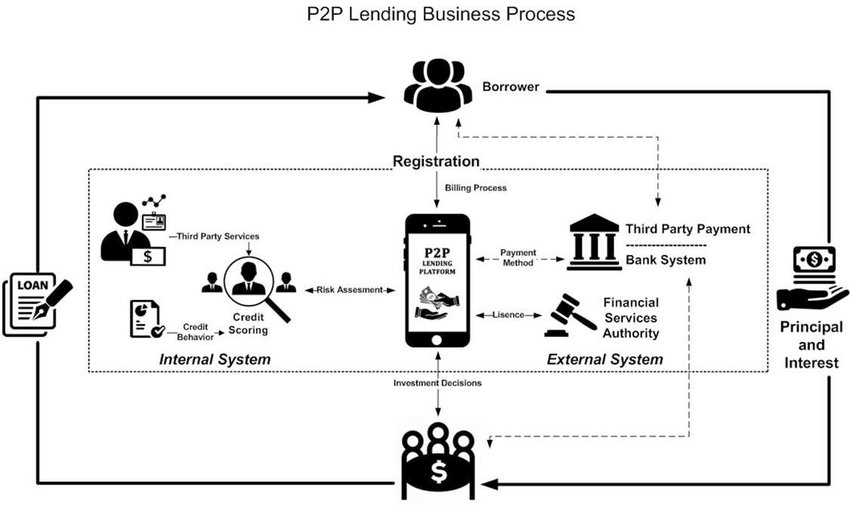

Peer-to-peer (P2P) lending has grown in India as an alternative to traditional lending institutions. P2P lending, where users lend money to borrowers who pay it back with interest, has become a feasible option for borrowers and lenders with 1.7 billion adults unbanked worldwide.

Unsecured loans are made using an internet portal. Borrowers are those who need loans, and the platform or borrower and lender can decide the interest rate.

After the RBI established P2P lending guidelines in 2016, this notion took off in India. P2P lending is expected to reach $804.2 billion by 2030, expanding at 29.1% from 2022 to 2030, according to Acumen Research and Consulting.

Technology has helped grow peer-to-peer lending. Digital technology powers P2P lending platforms from loan origination, fundraising, disbursals, and repayments. As this system evolves as an alternative to traditional lending institutions, using digital procedures has helped people to reduce costs and address global transparency issues.

Trust, Transparency, Technology: P2P Lending

Lack of knowledge and openness plagues the P2P ecosystem. Unlike banks and other financial institutions, P2P platforms are digital enterprises that aggregate lenders and borrowers.

Lack of communication and transparency promotes confidence in the ecosystem, and platforms are not accountable for borrower delays or defaults. Some gamers devised unhealthy rules to fight this issue, raising concerns of detrimental effects.

Several platforms have introduced transparent P2P loan options to address these challenges. Trust is built through developing a database and giving investors with precise information on the loans they are investing in, including the borrower’s credit score, income, and other financial information.

Technology may assist platforms safeguard real-time data and analytics, which can increase lending process transparency.

Democratizing Credit Access with Technology

Peer-to-peer (P2P) systems may utilise IndiaStack technologies and protocols like OCEN, ONDC, and AA to improve user experience. In the future, these advances will make transactions quicker, fairer, more secure, and more transparent and trustworthy.

P2P lending is expanding rapidly, generating new investment venues for fintech professionals. Next-generation investors are using P2P lending applications instead of traditional financing.

P2P platforms will flourish by using AI to minimize biases in credit underwriting, make lending more inclusive, uncover trends, and make accurate creditworthiness projections.

This solution reduces the chance of human biases unjustly impacting loan choices, allowing more individuals to obtain finance and accomplish their financial goals.

The Future

P2P lending is becoming a popular alternative to traditional lending, and technological advances have helped. While there is a large gap between the demand for credit and its supply in the Indian economy, whether for individual borrowers or businesses, P2P lending has the potential to greatly benefit last-mile individuals by lowering credit costs, creating a financially inclusive ecosystem for all.