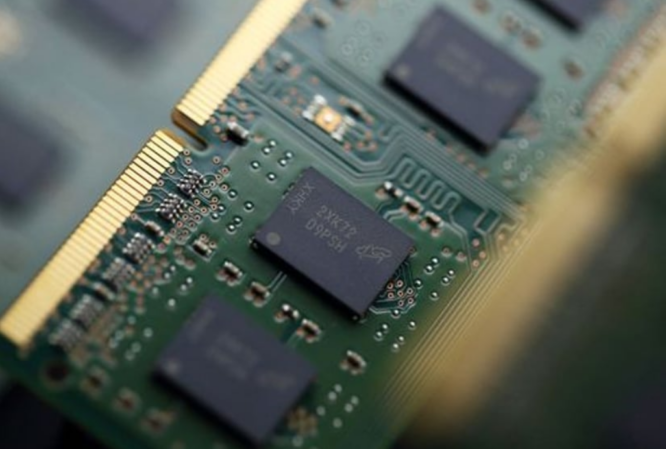

US chipmaker Micron says a prohibition on selling to Chinese businesses working on important infrastructure projects might cost it a “high single digit” percentage of its yearly sales.

Beijing announced the restrictions on Sunday, escalating a spat between the world’s two largest economies over technological access.

The CAC stated the firm failed a cybersecurity evaluation. The report followed the G7 conference in Hiroshima, Japan, when leaders of key democracies voiced their rising worries over China.

The Chinese regulator stated that Micron’s products had “relatively serious cybersecurity risks,” which threaten China’s vital information infrastructure supply chain and national security.

It advised domestic critical information infrastructure operators to cease buying Micron goods.

Micron Technology (MU) fell 3% Monday. Asian competitors finished higher. Ingenic Semiconductor gained 2.8%. Techwinsemi rose 6.3%. Feiji Electronics rose 14%. SK Hynix, the world’s largest memory chip producer, rose 0.9% in Seoul, surpassing the market.

In apparent retribution for US-led restrictions on China’s semiconductor sector, the Chinese regulator began a cybersecurity examination of Micron’s goods seven weeks earlier.

Micron is a major US memory chip producer. Its mainland China revenue exceeds 10%.

CNN said that the corporation was reviewing the regulator’s notification.

“We look forward to continuing discussions with Chinese authorities,” it stated.

On Monday, Micron CFO Mark Murphy said the business was unsure of Beijing’s security worries. He said the corporation is assessing the sales impact.

“We are currently estimating a range of impact in the low single digits percent of our company total revenue at the low end and high single-digit percentage at the high end,” he said at a conference.

The US Commerce Department strongly opposed the “baseless” limitations.

“This action, along with recent raids and targeting of other American firms, is inconsistent with [China’s] assertions that it is opening its markets and committed to a transparent regulatory framework,” a department spokeswoman said.

The prohibition “very seriously concerns” the US State Department.

“The Department of Commerce is engaging directly with the PRC to make our view clear, and broadly, this action appears inconsistent with the PRC’s assertions that it is open for business and committed to a transparent regulatory framework,” US State Department spokesperson Matthew Miller said Monday.

China’s Foreign Ministry stated Sunday that G7 leaders were “hindering international peace” and needed to “reflect on its behavior and change course.”

China’s Economic coercion

In a landmark joint communique Saturday, G7 member countries stressed the need to cooperate with the world’s second-largest economy while also opposing its “malign practices” and “coercion.”

Washington has restricted Chinese exports of sophisticated semiconductors and chip-making equipment since October 2022 to deny China military technologies.

In March, US allies Japan and the Netherlands restricted chip-making technology exports to China. China called the limitations “discriminatory containment” against the country.

Beijing’s digital superpower ambitions depend on chips. China makes low- to mid-range processors for household appliances and electric cars.

China and the US are growing apart over semiconductors. The two have had their worst relations in decades.

After US fighter aircraft shot down a suspected Chinese spy balloon in February and Beijing deepened its connections with Russia despite its invasion of Ukraine, tensions rose this year.

On Sunday, US President Joe Biden predicted improved relations between the two nations.

“I think you are gonna see that begin to thaw very shortly,” Biden told a press conference after the Group of Seven meeting in Japan.

He said he had agreed with Chinese President Xi Jinping in November to keep communications open, but everything changed after a “silly balloon that was carrying two freight cars worth of spying equipment” was shot down.

“We will not decouple from China,” he declared. “We want to diversify and de-risk China.”