As drilling expenditures dwindle, so do the research and development that may lead to the next great leap in shale technology, which drove the U.S. to the top global oil producer with world-beating growth rates.

Directional drilling and hydraulic fracking increased U.S. oil output to the world’s highest in 2018 and shale production to over 8 million barrels per day from 2.6 million a decade earlier.

Tight-fisted producers invest only enough to maintain output under growing costs and prefer dividends and stock buybacks, reducing output growth.

Lack of investment has slowed oil expansion as productive regions run out. Executives and experts believe there is not enough high-quality shale to survive another decade.

Oil service corporations, paying down debt and shareholders, are investing in less-polluting electric drilling rigs, fracturing equipment, and carbon sequestration. That leaves less money for discovering ways to make secondary properties significant producers.

“The technology interests are in new frontiers of geothermal, hydrogen, and biofuels,” said Pulitzer Prize-winning oil historian and S&P Global (SPGI.N) vice chairperson Daniel Yergin. “There is no other transformative technology that will change the global market.”

Acquisitions are helping producers grow production. Chevron Corp (CVX.N) paid $7.6 billion in stock and debt for PDC Energy Inc (PDCE.O) on Monday, adding 10% to its oil and gas reserves. Chevron cut R&D to $268 million last year from $435 million in 2020.

WITHOUT R&D?

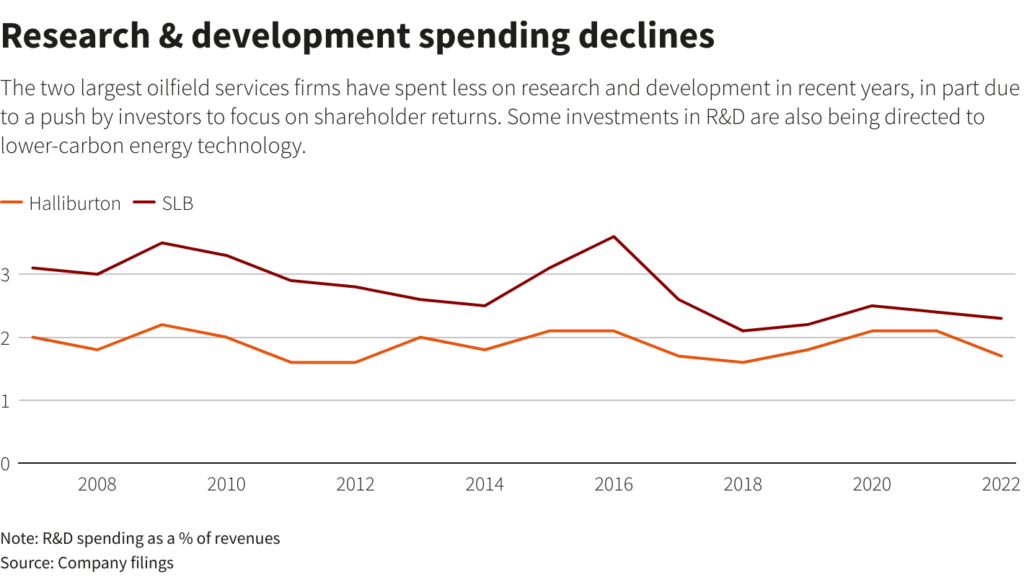

According to a Reuters study of its financial papers, SLB (SLB.N), the world’s largest oilfield services provider and a key inventor, spent 3% of revenues on research and engineering in the 10 years to 2017. 2016 expenditure reached 3.6% of revenue.

SLB’s R&D investment has reduced to 2.3% of revenues, with part going to its New Energies business, which develops lower-carbon energy for oil clients.

“Who spends on the effort to make a tier 2 oil property into a tier 1?” argues energy consultancy Veriten partner Arjun Murti, a former Goldman Sachs analyst. “No one.”

SLB declined to discuss its R&D investment.

Richard Spears, who sits on the boards of many oilfield services businesses, said most are spending their limited capital on tool durability, international expansion, or debt repayment.

“This is not technology development,” he remarked. “Buyers are pricing tomorrow’s technologies at zero or even negative since full commercial development takes resources… “The return of that capital is uncertain,” Spears warned.

Production predictions show no new technologies. As new-well productivity declines, Enervus believes that the Permian, the largest U.S. shale basin and oilfield, will increase output by 400,000 bpd this year. In 2018, it rose 1.1 million bpd.

Horizontal drilling, fracking, and completions propelled shale worldwide. “Outside of digital tools, there may never be another industry advancement like that in our lifetime,” said Ascent Energy Ventures founder David Forsberg.

Companies are using traditional methods to extract more oil in the absence of fresh discoveries.

Pioneer Natural Resources Co (PXD.N), formerly the fastest-growing shale oil producer, is attempting enhanced oil recovery, a decades-old method that pumps water or gas into a well to extract additional oil.

Pioneer Natural CEO Scott Sheffield sees it as addressing left-over oil. Squeezing more oil from the Permian will extend the shale sector, where businesses are only extracting 6%.

“There are always little things, whether it is re-fracs or enhanced oil recovery on shale wells,” said Enverus managing director Dane Gregoris. That won’t grow you. It won’t reverse U.S. economic losses.”