Xeros Technology Group plc (LON:XSG) looks to be on the verge of a major achievement, making it an ideal moment to analyze its business. Xeros Technology Group plc and its subsidiaries develop and market polymer-based technologies worldwide.

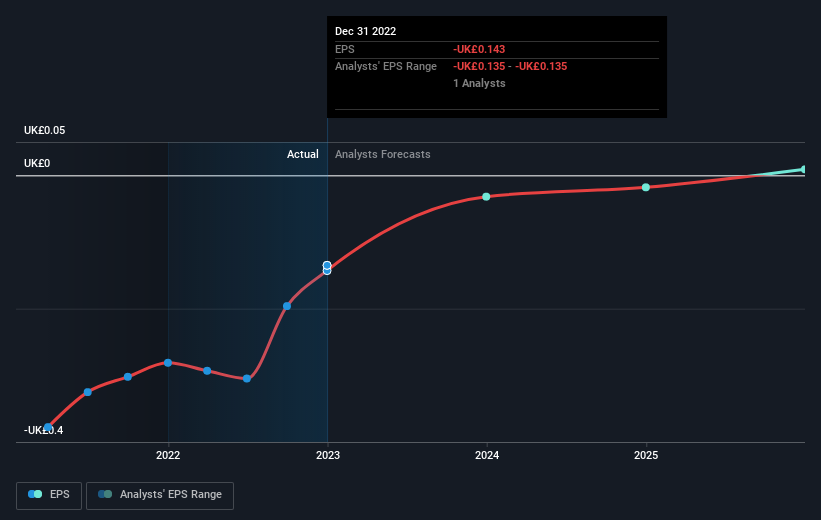

The UK£4.7m market-cap firm reported a UK£6.9m loss on 31 December 2022. We’re measuring market sentiment because Xeros Technology Group investors are focused on profitability. We’ll summarize industry experts’ corporate expectations below.

British Machinery experts say Xeros Technology Group is nearing breakeven.

They anticipate a last deficit in 2024 and a UK£1.3m profit in 2025. The firm should breakeven in two years. How fast must the firm expand annually to breakeven on this date? A line of best fit yielded an optimistic average yearly growth rate of 68%! If this pace is excessively aggressive, the firm may become profitable later than experts expect.

We won’t delve into details of Xeros Technology Group’s forthcoming initiatives, but keep in mind that a firm in an investment phase usually has a high predicted growth rate.

One last thing. Unlike most cash-burning growing companies, Xeros Technology Group has no debt on its financial sheet. The firm has no debt and runs on shareholder finance, making it a safer investment.

Next Steps

Xeros Technology Group’s Simply Wall St. corporate page has all the firm’s essentials. We’ve also included pertinent topics to research:

- What’s Xeros Technology Group worth today? Has the pricing considered future growth? Our free research report’s intrinsic value infographic shows Xeros Technology Group’s market mispricing.

- Management Team: Xeros Technology Group’s board and CEO inspire confidence.

- Other High-Performing Stocks: Are there better alternatives with established track records? Browse our free list of outstanding stocks.